TPL Properties completes Rs7bn strategic investment in REIT Fund

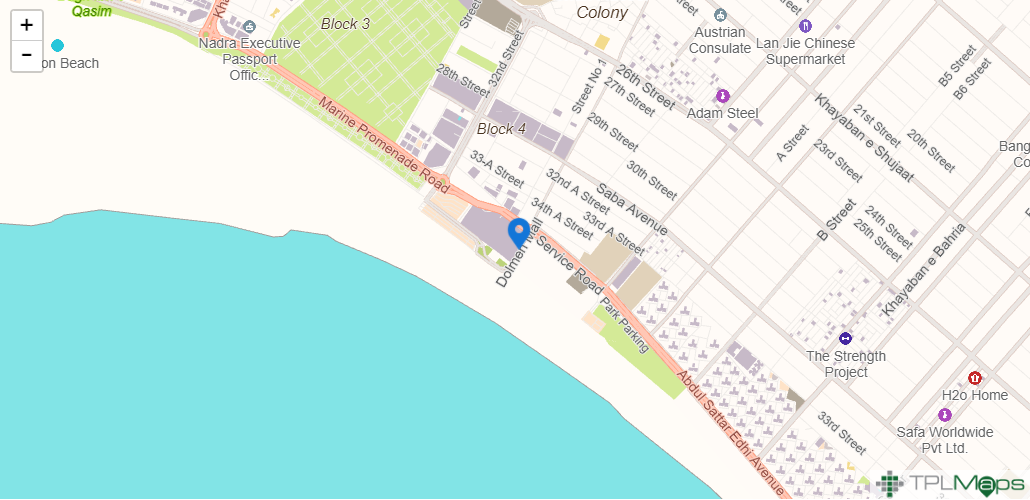

TPL Properties Limited (TPLP) has successfully completed a strategic investment of Rs7.1 billion in TPL REIT Fund, after the latter completed land acquisition for its ‘Tech Park’ project.

“We are pleased to announce that our TPL REIT Fund I has completed its acquisition of initial portfolio of real estate assets after completing the acquisition of land for Tech Park project by way of acquiring 100% stake in TPL Technology Zone Phase I (Pvt) Ltd (“SPV”) from TPL Properties Limited against the issuance of 162.5 Million REIT units,” read a filing sent by TPLP to the Pakistan Stock Exchange (PSX).

“This transaction has completed the strategic investment of Rs7,100 million in the Fund by TPL Properties Limited,” it added.

TPL REIT is the first and largest Shariah-compliant Development Impact real estate investment trust Fund in Pakistan and its eventual size is envisaged at Rs80 billion, which will be raised from local and international investors.

Earlier in March, TPL REIT Management Company Ltd (TPL RMC), a wholly-owned subsidiary of TPL Properties Ltd, secured its first funding round of Rs18.35 billion for its TPL REIT Fund I .

Subsequently in May, the company entered into unit subscription agreements for its first funding round of Rs18.35 billion in its TPL REIT Fund I (fund), paving way for the acquisition of assets.

TPLP was incorporated in Pakistan as a private limited company in February 2007 under the repealed Companies Ordinance, 1984. In 2016, the company changed its status from private limited company to a public company.

The principal activity of the company is to invest, purchase, develop and build real estate and to sell and rent out properties including commercial and residential buildings, houses, shops and plots.

At the time of this report, the scrip of TPLP was being traded at Rs19.60, an improvement of Re0.11 or 0.56%.

For Refference:

https://www.brecorder.com/news/40213985/tpl-properties-completes-rs7bn-strategic-investment-in-reit-fund